Pricing in Nonconvex Markets: How to Price Electricity in the Presence of Demand Response

Abstract

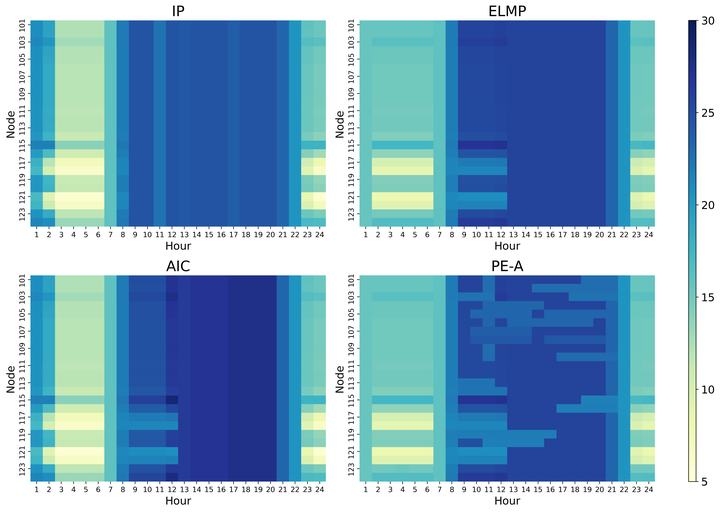

A Walrasian competitive equilibrium defines a set of linear and anonymous prices where no coalition of market participants wants to deviate. Walrasian prices do not exist in nonconvex markets in general, with electricity markets as an important real-world example. However, the availability of linear and anonymous prices is important for derivatives markets and as a signal for scarcity. Prior literature on electricity markets assumed price-inelastic demand and introduced numerous heuristics to compute linear and anonymous prices on electricity markets. At these prices, market participants often make a loss. As a result, market operators provide out-of-market side-payments (so-called make-whole payments) to cover these losses. Make-whole payments dilute public price signals and are a significant concern in electricity markets. Moreover, demand-side flexibility becomes increasingly important with growing levels of renewable energy sources. Demand response implies that different flexibility options come at different prices, and the proportion of price-sensitive demand that actively bids on power exchanges will further increase. We show that with price-inelastic demand there are simple pricing schemes that are individually rational (participants do not make a loss), clear the market, support an efficient solution, and do not require make-whole payments. With the advent of demand-side bids, budget balanced prices (no subsidies are necessary) cannot exist anymore, and we propose a pricing rule that minimizes make-whole payments. We describe design desiderata that different pricing schemes satisfy and report results of experiments that evaluate the level of subsidies required for linear and anonymous prices on electricity spot markets with price-sensitive demand.